Implementing EU VAT validation in an e-commerce website is essential for ensuring compliance with European Union regulations regarding the collection and reporting of Value-Added Tax (VAT) on digital goods and services. This validation process verifies the VAT identification numbers (VATINs) provided by customers at the point of sale. By integrating EU VAT validation functionality into an e-commerce website, businesses can automatically validate VAT numbers in real time, reducing the risk of errors and ensuring accurate VAT calculation and invoicing. This not only helps businesses comply with EU tax laws but also enhances customer trust and minimizes the risk of fraud.

Table of Contents

ToggleWhat is the WooCommerce EU VAT Validation Plugin?

The WooCommerce EU VAT Validation Plugin is a valuable tool designed to assist e-commerce businesses in complying with European Union regulations regarding Value-Added Tax (VAT) on digital goods and services. This plugin seamlessly integrates with WooCommerce-powered websites, enabling automatic validation of VAT identification numbers (VATINs) provided by customers during the checkout process.

Overall, this plugin is an essential resource for e-commerce businesses operating within the EU, providing the necessary functionality to streamline VAT validation processes and maintain compliance with regulatory requirements.

List of WooCommerce EU VAT Validation Plugins

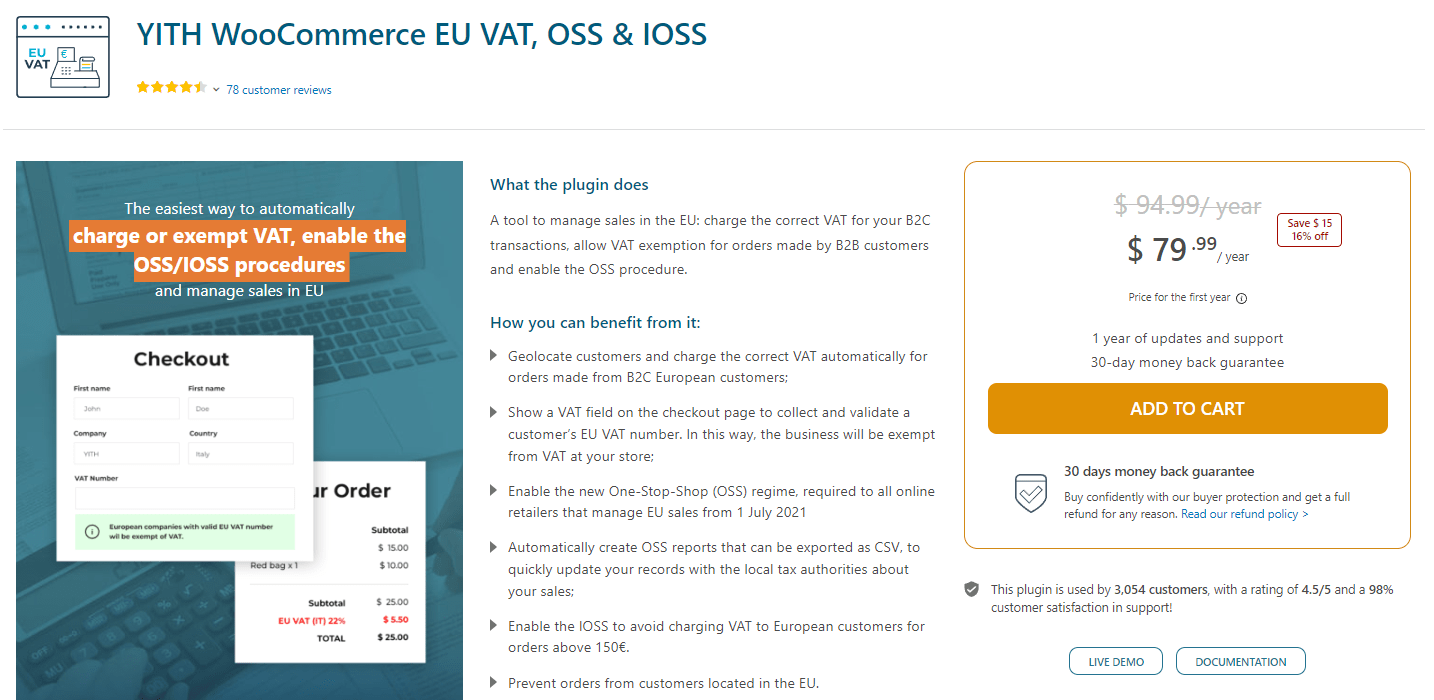

1. YITH WooCommerce EU VAT, OSS & IOSS

The YITH WooCommerce EU VAT, OSS & IOSS plugin is a vital tool for e-commerce store owners operating within the European Union. It simplifies compliance with EU VAT laws by automatically identifying customers’ locations and applying the correct VAT rates for B2C orders. For B2B transactions, the plugin offers a VAT validation field on the checkout page, allowing businesses to validate their VAT numbers and be exempted from VAT charges.

Key Features of YITH WooCommerce EU VAT, OSS & IOSS

- Display the VAT field on the Checkout page and specify whether it’s optional or mandatory.

- Geolocate users to determine the correct VAT based on their countries.

- Request country confirmation if the IP address doesn’t match the country inserted in the billing information.

- Restrict purchases to customers with valid VAT numbers.

- Choose whether to display the VAT field to customers from the same country as the shop.

Pricing

$ 94.99/ year

Buy Now Hire WooCommerce Experts

2. EU Tax Number

The EU Tax Number plugin adds a field to your checkout page for customers to input and validate their EU VAT numbers. Valid numbers exempt businesses from tax charges, ensuring compliance with EU tax regulations and streamlining transactions.

Key Features of EU Tax Number

- Collection and validation of EU VAT numbers during checkout.

- VAT exemption for eligible companies.

- Collection and validation of user location for B2C transactions.

- Management of EU tax compliance for digital products.

Pricing

$3.25/ Monthly

Buy Now Hire WooCommerce Experts

3. EU VAT Manager for WooCommerce

The EU VAT Manager for WooCommerce plugin streamlines EU/UK VAT compliance for your WooCommerce store effortlessly. This powerful tool automates VAT settings, validation through the VIES system, and tax application, ensuring a seamless and compliant experience for customers. By automating VAT-related processes, the plugin simplifies the management of VAT requirements, reducing the risk of errors and ensuring compliance with EU and UK tax regulations.

Key Features of EU VAT Manager for WooCommerce

- Advanced VAT validation checks for accuracy.

- Customizable and intuitive frontend interface options.

- Ability to show VAT fields and apply settings based on user roles.

- Real-time and precise EU and UK VAT validation for seamless compliance.

Pricing

$6.67/month

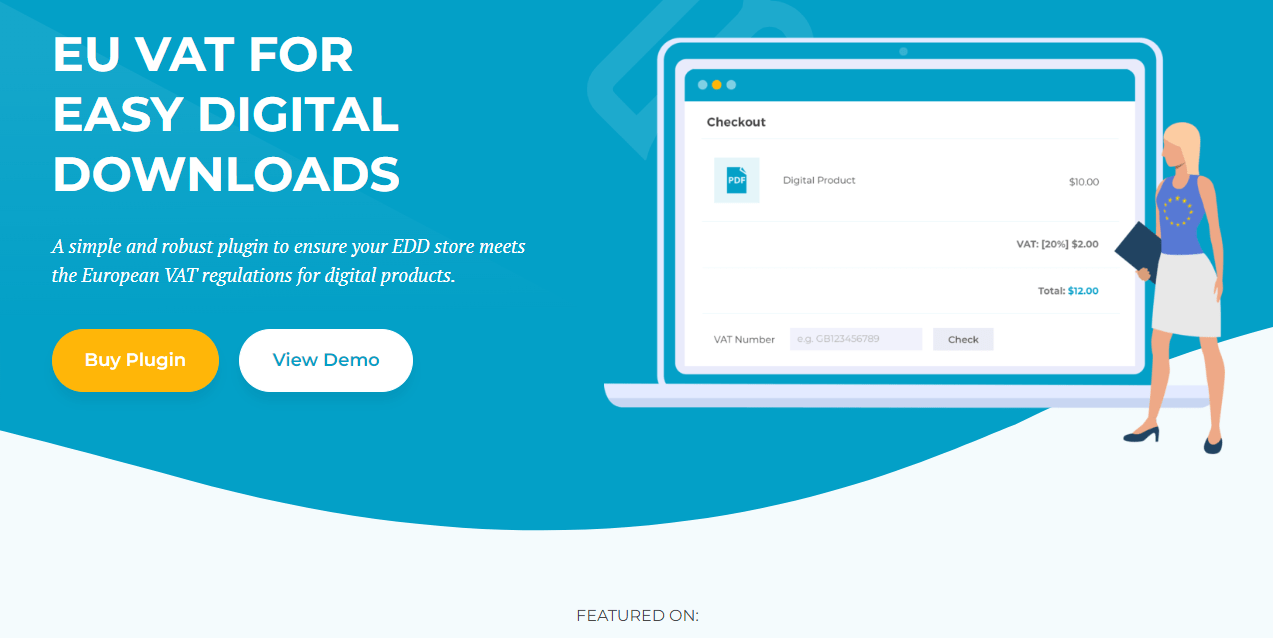

4. EU VAT for Easy Digital Downloads

EU VAT for Easy Digital Downloads is a straightforward yet powerful plugin designed to guarantee compliance with European VAT regulations for digital products in your EDD store. This plugin provides a seamless solution for handling VAT obligations, ensuring that your store adheres to the necessary regulations effortlessly.

Key Features of EU VAT for Easy Digital Downloads

- Automatically applies the correct VAT rates for sales to each EU country and the UK.

- Validates and securely stores customers’ VAT numbers for compliance purposes.

- Removes and reverse-charges VAT on business-to-business (B2B) sales as required.

- Integrates seamlessly with Easy Digital Downloads (EDD) to capture and store multiple location evidence.

- Collects and displays both postal and IP addresses for thorough compliance tracking.

- Provides an easy-to-use interface for checking and exporting evidence, ensuring readiness for audit purposes.

Pricing

$299

Buy Now Hire WooCommerce Experts

5. EU/UK VAT Compliance Assistant for WooCommerce

EU VAT for Easy Digital Downloads efficiently handles VAT compliance for digital products by identifying customer locations through billing or shipping addresses and IP addresses via GeoIP lookup. It records this evidence for auditing purposes, conveniently accessible from the WooCommerce order screen. It ensures an accurate display of prices including the correct VAT from the initial interaction with the product, utilizing GeoIP information and providing widgets and shortcodes for customers to set their own country easily.

Key Features of EU VAT for Easy Digital Downloads

- Efficient VAT compliance for digital products.

- Identification of customer locations through billing/shipping addresses and IP addresses via GeoIP lookup.

- Recording of evidence for auditing purposes, accessible from the WooCommerce order screen.

- Accurate display of prices including correct VAT from the first interaction with the product.

Pricing

Free

Final Words on WooCommerce EU VAT Validation Plugins

WooCommerce EU VAT validation plugins offer essential solutions for ensuring compliance with European Union VAT regulations within your e-commerce store. By automatically validating VAT numbers, applying the correct VAT rates for each EU country and the UK, and facilitating the management of B2B transactions, these plugins streamline the VAT compliance process. Additionally, their ability to capture and store customer location evidence, including postal and IP addresses, enhances transparency and audit readiness. With user-friendly interfaces and robust features, these plugins empower businesses to navigate the complexities of EU VAT regulations with ease, enabling them to focus on their core operations while maintaining regulatory compliance and fostering trust with customers.

Interesting Reads:

10 Best WordPress Cookie Plugins

Benefits of Real-Time Email Validation for E-commerce Businesses